Online Gambling Stocks Etf Average ratng: 4,9/5 6145 reviews

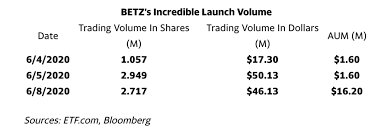

Investors are making big ‘BETZ’ on this online sports and gaming ETF Jun. 25, 2020 at 2:38 p.m. Sports Betting ETFs, Stocks to Surge on More Legalization. With that in mind, the team at Roundhill Investments recently started a new Exchange Traded Fund that focuses on sports gambling, online sports gambling and iGaming. The ETF is called the Roundhill Sports betting & iGaming ETF. (Amazing ticker by the way.). Goldman Sachs expects sports betting to become a $28 billion industry and iGaming or online gambling to become a $9.5 billion industry. BETZ, the first and only ETF to provide exposure to this. You Can Bet On Stocks And Sports With This New iGaming ETF. Entertainment ETF. That more cash-starved states will turn to online casinos and sports gambling as avenues for bolstering.

- Online Gambling Stocks Etfs

- Online Gambling Stocks To Buy

By Chris Markoch

By Chris MarkochOnline Gambling Stocks Etfs

of InvestorPlace

Online Gambling Stocks To Buy

Exchange traded funds (ETFs) have become one of the most popular investment vehicles over the last 10 years. And like many index funds, there are index funds to fit every investing style. If you’re an investor whose personal convictions allow you to invest in sin stocks, then there are some vice ETFs that you may want to consider. Sin stocks are companies that allow us to indulge our vices. These include gambling, alcohol, tobacco, and cannabis companies. However, they also now capture the gaming community in all its forms. Most of the sin stocks were hit hard at the onset of the pandemic. But many of these categories are coming back. One reason for that is mounting evidence that our nation is moving on from the pandemic. As it relates to sin stocks, casinos have reopened in many states. The return of live sports has provided a catalyst for online and in-person sports books. Several states just passed ballot initiatives to legalize recreational marijuana. And while the bar and restaurant industry is still providing a drag on alcohol sales, it appears that consumers are still stocking their home bars. Here are 5 vice ETFs for safe investment in sin stocks: AdvisorShares Vice ETF (NYSEARCA:VICE) VanEck Vectors Gaming ETF (NYSEARCA:BJK) VanEck Vectors Video Gaming and eSports ETF (NYSEARCA:ESPO) ETFMG Alternative Harvest ETF (NYSEARCA:MJ) Invesco Dynamic Leisure & Entertainment ETF (NYSEARCA:PEJ) Sin stocks remain volatile, and as I mentioned above, not all vice stocks are performing equally well. That’s a good reason to look at vice ETFs for portfolio exposure.

© InvestorPlace By Chris Markoch

By Chris Markoch